Managing personal finances is essential for maintaining stability, saving, and achieving long-term goals. Here are some top personal financial management applications available today.

Table of Contents

Personal Financial Management Application

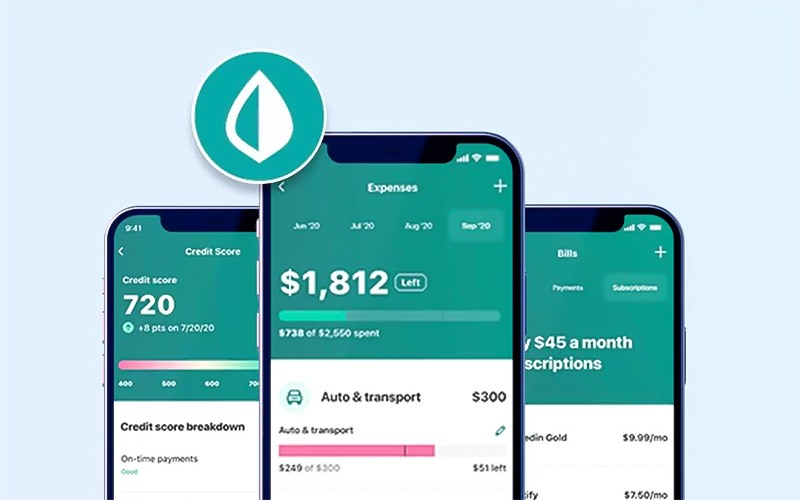

1. Mint

Mint is a widely popular personal finance management app, known for its powerful budgeting tools. It helps users easily track expenses, set budgets, and manage bank accounts, credit cards, bills, and debts. Mint allows users to gain better control over their finances and establish saving habits. Notably, Mint enables personalized budget setup for each expense category, tracks spending, and alerts users when they’re close to exceeding their budget limit.

Key Features:

- Automatic tracking and categorization of transactions.

- Personal budget planning.

- Bill payment reminders.

- Savings suggestions based on spending.

- Free credit score reports.

Available for:

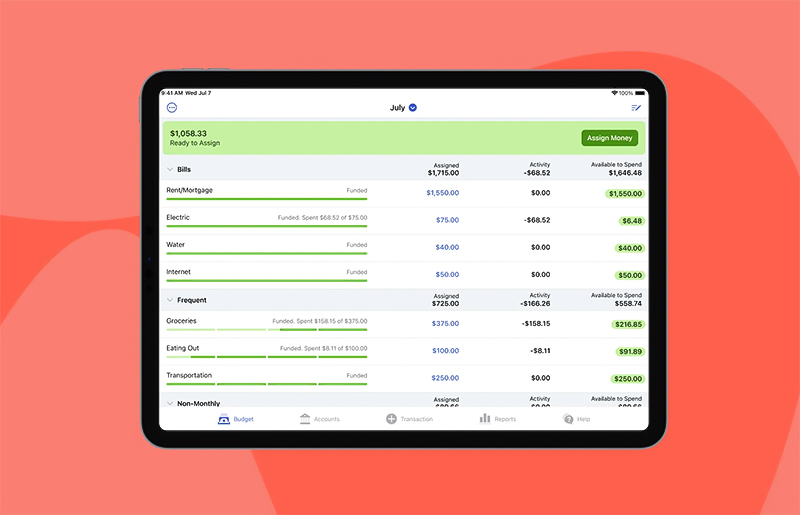

2. YNAB (You Need A Budget)

YNAB, short for “You Need A Budget,” is a highly regarded personal finance app designed to help users plan their finances and manage money effectively. This app focuses on transforming users’ financial habits, requiring them to allocate all available funds into specific budget categories like housing, shopping, dining, bills, savings, and investments. YNAB is ideal for those who want strict control over income and expenses and aim to improve personal financial habits.

Key Features:

- Comprehensive budgeting system.

- Real-time sync across multiple accounts.

- Detailed expense reports.

- Goal-oriented financial planning.

- Personal finance education through articles and videos.

Available for:

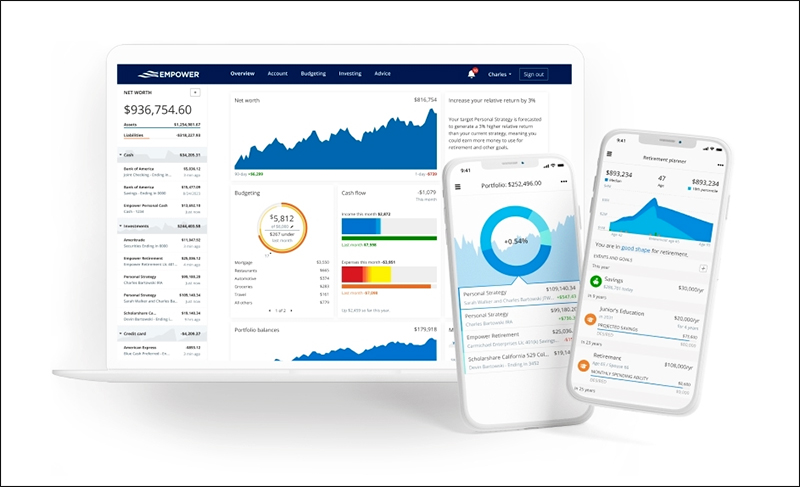

3. Empower personal dashboard

Previously known as Personal Capital, the Empower Personal Dashboard is a comprehensive personal finance management app. Empower focuses not only on tracking expenses but also offers robust tools for asset management and financial planning. It enables users to connect and monitor all financial accounts, including bank accounts, investments, retirement funds, and debts, providing a clear overview of total net worth and cash flow.

Key Features:

- Net worth tracking.

- Portfolio analysis and financial advisory.

- Retirement planning based on financial goals.

- Expense tracking and cash management.

Available for:

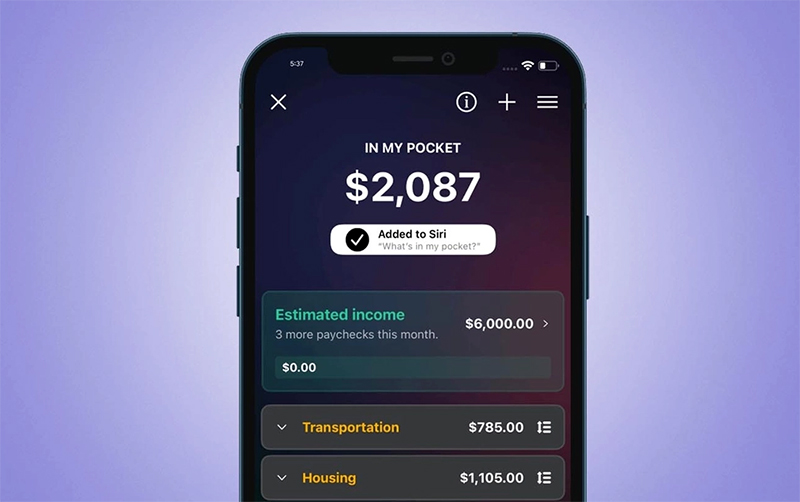

4. PocketGuard

PocketGuard is a personal finance management app designed to help users closely monitor and control daily spending. The app’s standout feature, “In My Pocket,” shows users exactly how much money they have left to spend after accounting for fixed expenses like rent, food, bills, debts, and savings goals. PocketGuard is well-suited for individuals who need tight control over their daily expenses.

Key Features:

- Automatic transaction tracking.

- Displays remaining spendable amount after fixed expenses.

- Expense reports by category.

- Cost-saving suggestions.

Available for:

5. Acorns

Acorns is an automated finance and investment app with a unique round-up feature. Each time a user makes a purchase with a linked bank or credit card, Acorns rounds up to the nearest dollar and invests the spare change. For instance, if you buy a coffee for $5.25, Acorns will round up to $6 and invest the remaining $0.75. This approach to micro-investing is ideal for beginners or those looking to build small investment funds.

Key Features:

- Automatically invests spare change from everyday purchases.

- Provides investment suggestions based on personal financial goals.

- Integrates retirement accounts (IRA) for long-term investments.

Available for:

>> Related: Top 32 Best Brain Games for Kids App

6. Quicken Simplifi

Quicken Simplifi is a comprehensive personal finance management app developed by Quicken, providing a simple yet thorough experience for tracking income and expenses, controlling finances, and planning budgets. With its straightforward interface, Simplifi helps users quickly grasp an overview of their financial status.

Key Features:

- Real-time income and expense tracking.

- Customizable spending plans.

- Detailed financial reports.

- Tracks savings and financial goals.

Available for:

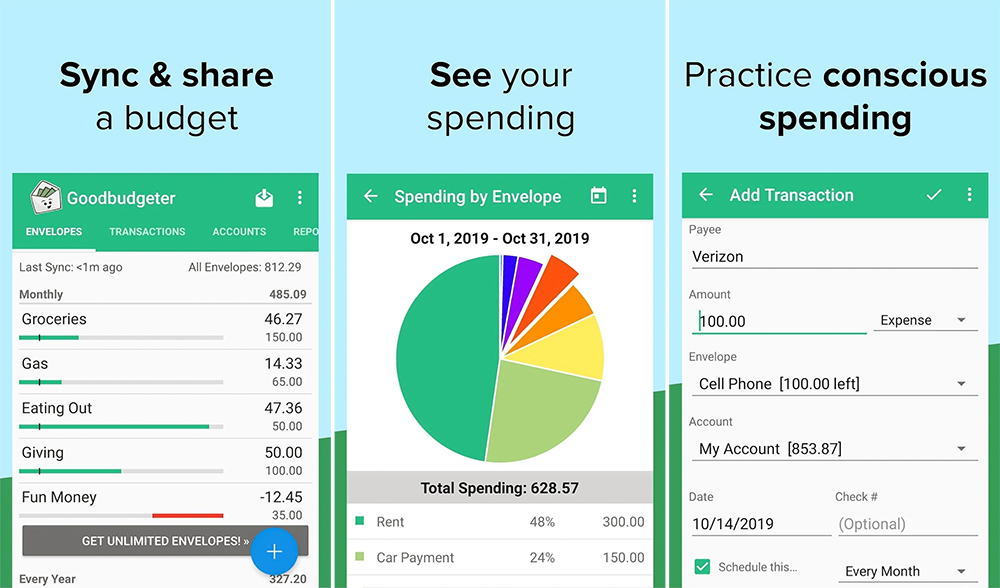

7. Goodbudget

Goodbudget is a personal finance management app based on the envelope budgeting method. It helps users manage spending, budget, and track income efficiently. Goodbudget allows users to allocate their monthly income into virtual envelopes for expenses like rent, food, entertainment, and shopping. Each envelope has its own spending limit, helping users avoid overspending.

Key Features:

- Envelope-based budgeting system.

- Data sync across devices.

- Detailed income and expense tracking.

- Goal-oriented financial planning.

Available for:

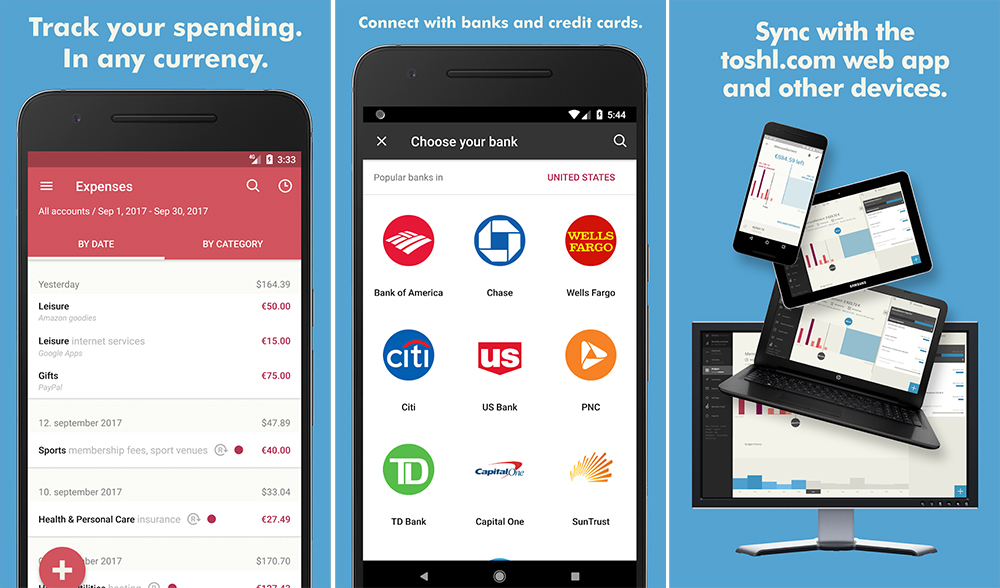

8. Toshl Finance

Toshl Finance is a useful personal finance management app that helps users track income and expenses, create budgets, and manage payment accounts. Toshl stands out with its expense reporting in chart form, allowing users to visualize and control their budgets easily.

Key Features:

- Expense tracking with visual charts.

- Multi-currency support, ideal for frequent travelers or international transactions.

- Bill reminders and recurring expense tracking.

- Flexible budget planning across various categories.

Available for:

9. Wally

Wally is a simple yet comprehensive personal finance management app that helps users track, control spending, and save. It enables users to log and monitor income and expenses in detail, with the option to add daily spending transactions for a clear financial overview.

Key Features:

- Category-specific expense tracking.

- Monthly financial reports and savings goals.

- Debt and cash management features.

- Easy-to-use interface with manual entry or automated input from bill photos.

Available for:

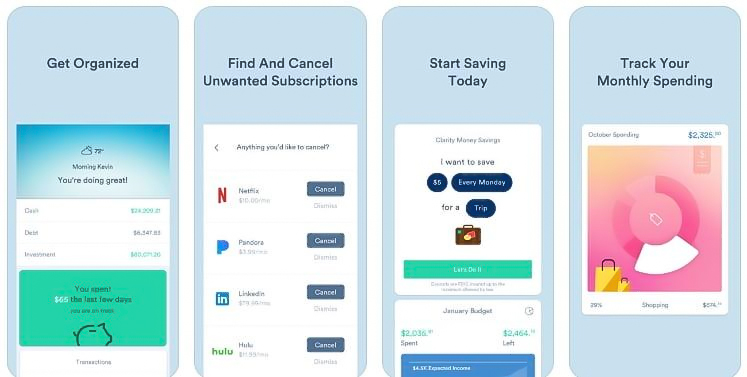

10. Clarity Money

Clarity Money is designed to help users easily track expenses and optimize personal finances. This app automatically monitors and categorizes users’ spending from transactions, bank accounts, and credit cards. Clarity Money can also identify unnecessary subscriptions, helping users cancel unused services to save money.

Key Features:

- Spending analysis and detection of unnecessary fees.

- Assistance with canceling unused subscriptions.

- Savings and investment strategy recommendations.

- Connects to multiple financial accounts, including credit cards and bank accounts.

Available for:

11. Albert

Albert is a standout personal finance management app with various useful features. It automatically tracks and categorizes users’ spending from daily transactions, bank accounts, and credit cards. Albert also includes the Albert Genius service, offering personalized financial advice from experts via messaging.

Key Features:

- Detailed income and expense tracking with budget planning.

- Automated financial analysis and savings suggestions.

- Investment and automatic savings features.

- Access to financial advice from experts through Albert Genius.

Available for:

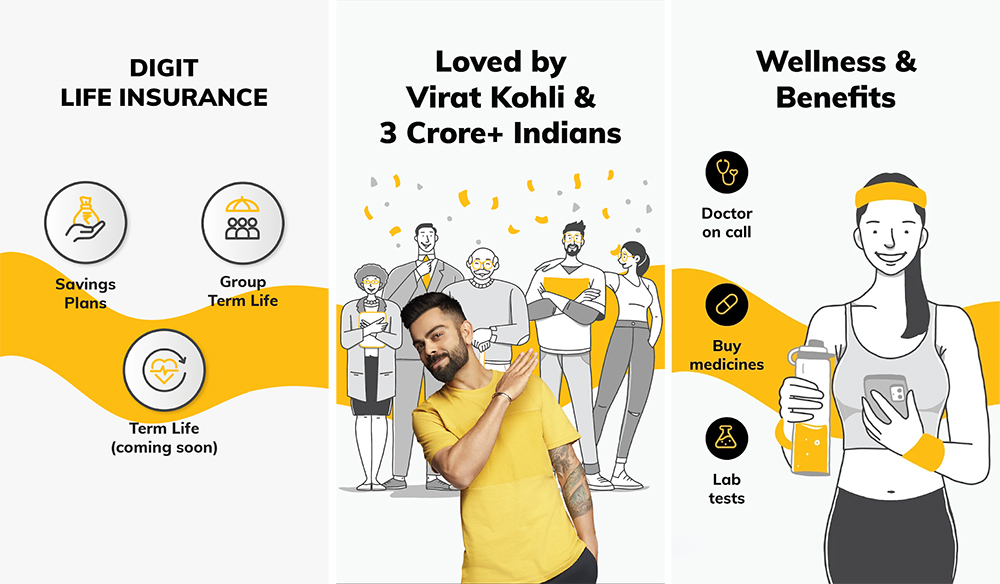

12. Digit

Digit is an automated savings app that analyzes spending habits and transfers small amounts into a savings account. Digit allows users to set budgets for each category, helping them monitor monthly spending and avoid overspending. It’s especially suited for those aiming to build up savings.

Key Features:

- Automated analysis and transfers to a savings account.

- Goal-setting for short- and long-term savings.

- Personal finance tracking and optimization.

- No detailed budget setup required; the app adjusts based on spending behavior.

Available for:

>> Related: Top 26 Best Piano App for Kids

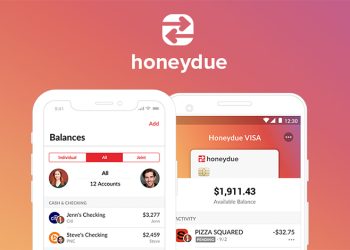

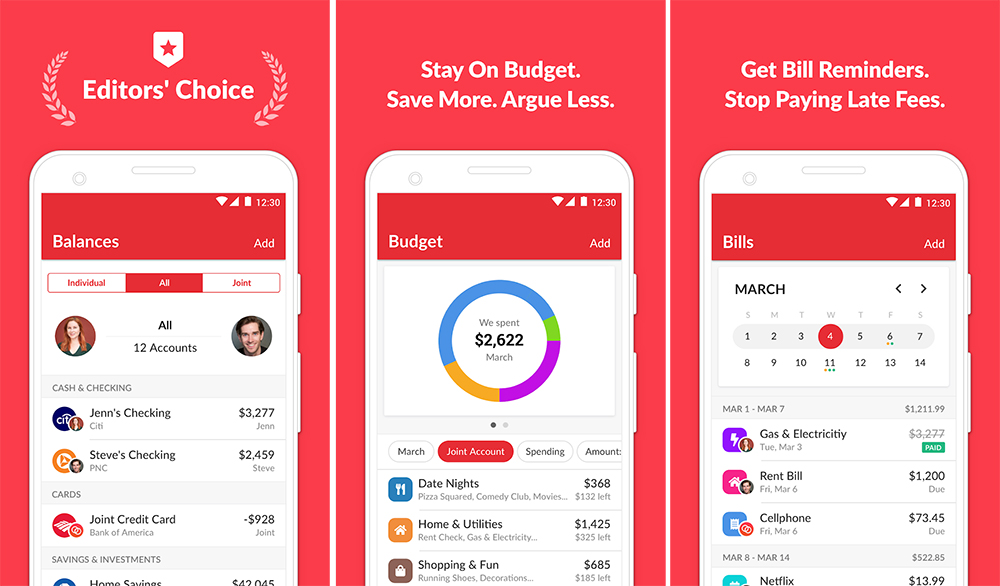

13. Honeydue

Honeydue is a finance management app specifically designed for couples. It enables couples to track expenses, share information, manage budgets, bills, and each other’s bank accounts while customizing the level of shared information according to comfort levels. Honeydue includes reminders for regular bills and expenses, helping couples manage finances effectively together.

Key Features:

- Shared and individual expense tracking for couples.

- Shared access to bank accounts and credit card information.

- Bill and recurring expense reminders.

- User-friendly interface for both partners.

Available for:

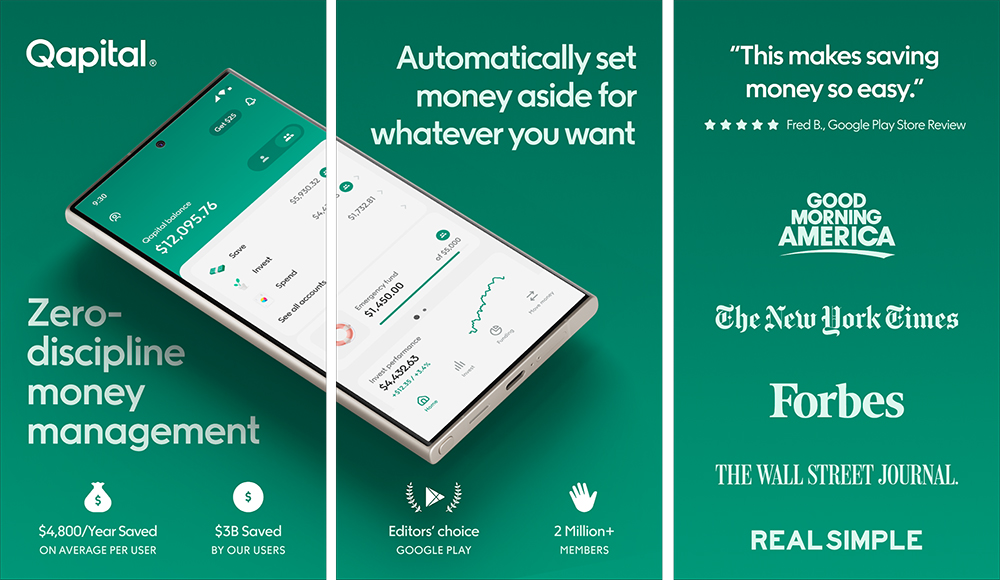

14. Qapital

Qapital is a personal finance app that helps users save money, manage spending, and invest. It lets users set automatic savings rules, like rounding up purchases and transferring the difference to a savings account. Qapital is ideal for those new to saving.

Key Features:

- Automatic savings based on custom rules.

- Daily spending tracking and account management.

- User-friendly interface.

- Long-term savings goal setting.

Available for:

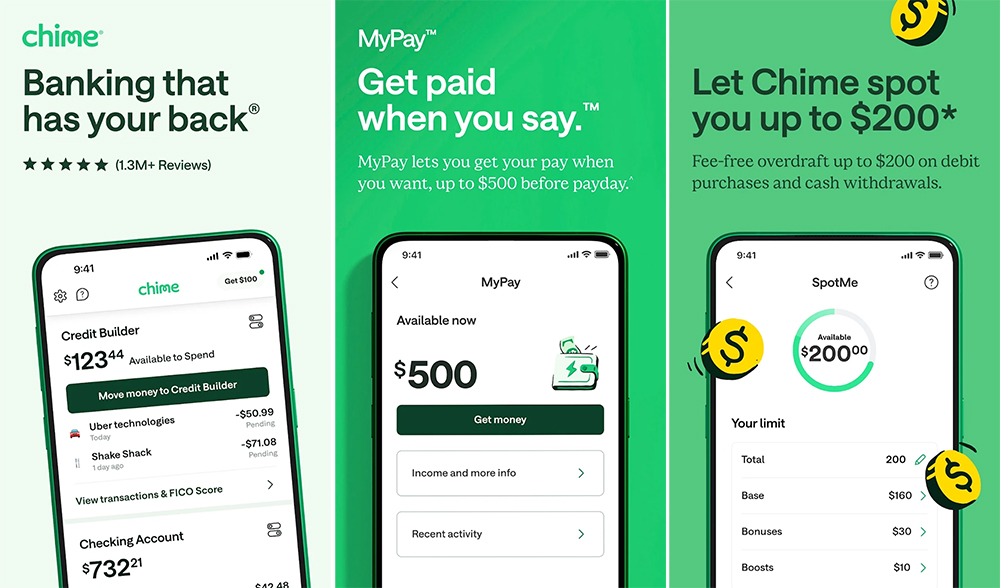

15. Chime

Chime is an online banking app with built-in personal finance management tools, allowing users to save and spend wisely. Chime provides financial reports and spending insights along with automatic and smart savings features.

Key Features:

- Automatic savings with a percentage of monthly income.

- Real-time tracking of spending and bank transactions.

- Alerts for unusual transactions.

- No hidden fees or service charges.

Available for:

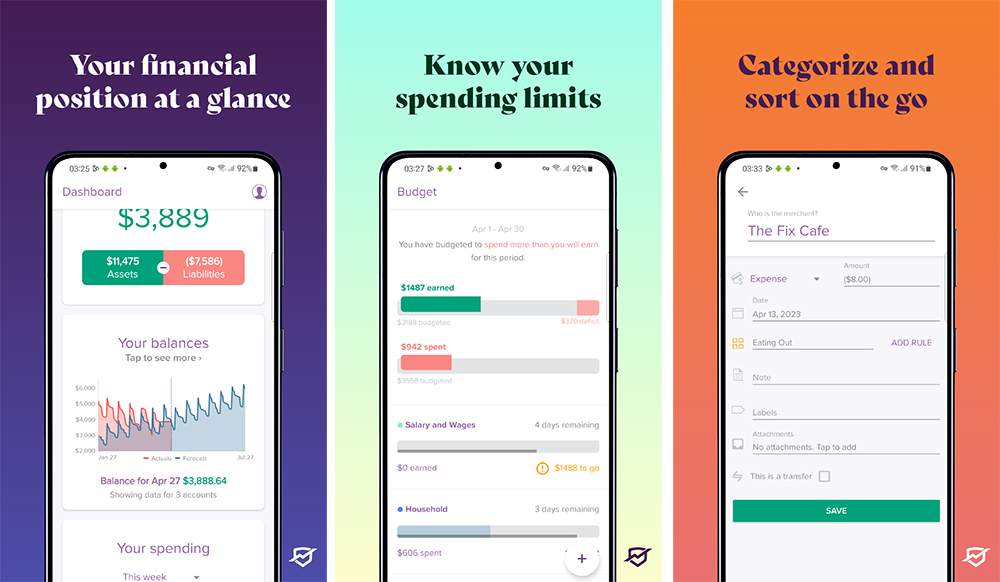

16. PocketSmith

PocketSmith is a powerful personal finance management app that helps users track and plan spending effectively. It enables users to categorize income and expenses and set up financial scenarios to visualize how decisions will impact long-term finances, helping identify costly expenses and manage finances better.

Key Features:

- Powerful financial forecasting tools.

- Daily expense tracking and budget planning.

- Automatic connection to bank accounts.

- Future financial scenario analysis.

Available for:

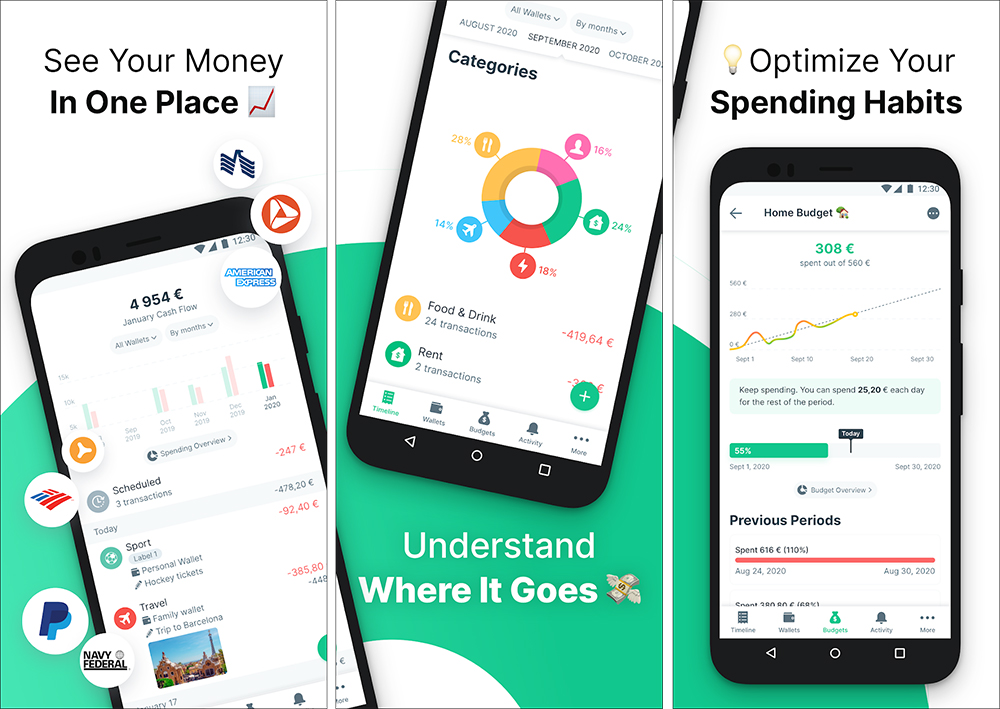

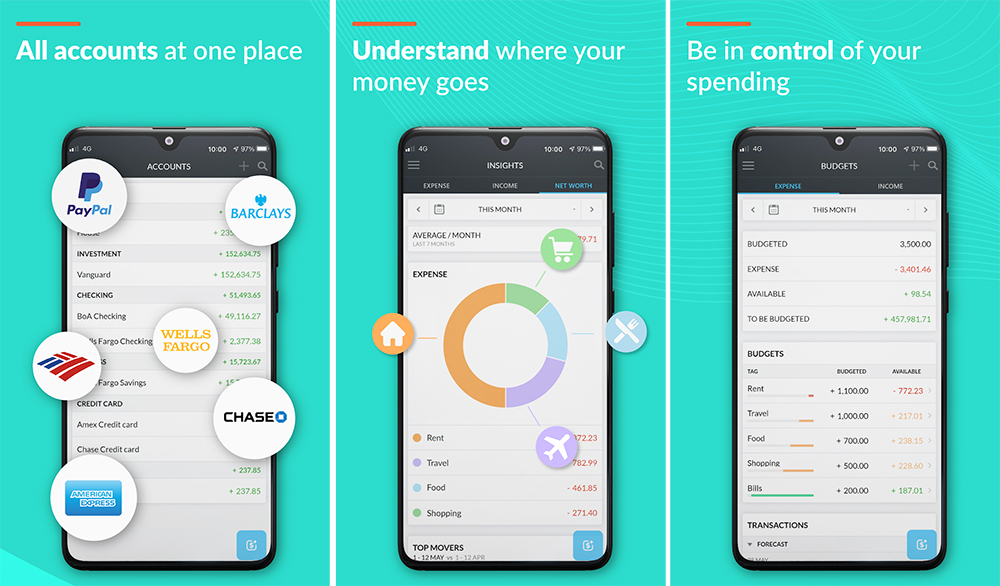

17. Spendee

Spendee is a versatile financial management app for individuals and families, allowing users to connect directly to bank accounts and track daily expenses in detail. Users can categorize expenses and income by category, giving a clear picture of spending and income sources.

Key Features:

- Connects to bank accounts and tracks transactions.

- Categorized expense tracking and budget planning.

- Option to share financial wallets with family.

- Visual financial reports and spending analysis.

Available for:

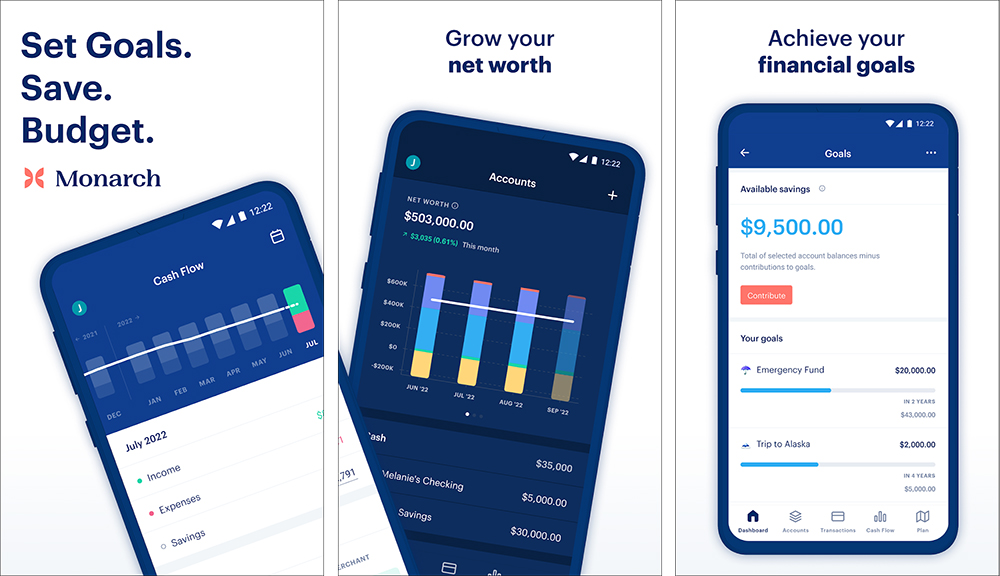

18. Monarch Money

Monarch Money is an all-in-one personal finance app that helps users plan and manage finances. It allows users to monitor and connect all bank accounts, credit cards, investments, and fixed assets like real estate.

Key Features:

- Comprehensive tracking of spending and investments.

- Long-term financial planning, including savings and investment goals.

- Modern, easy-to-use interface.

- Real-time financial reporting.

Available for:

>> Related: Top 30 Coloring Apps for Kids

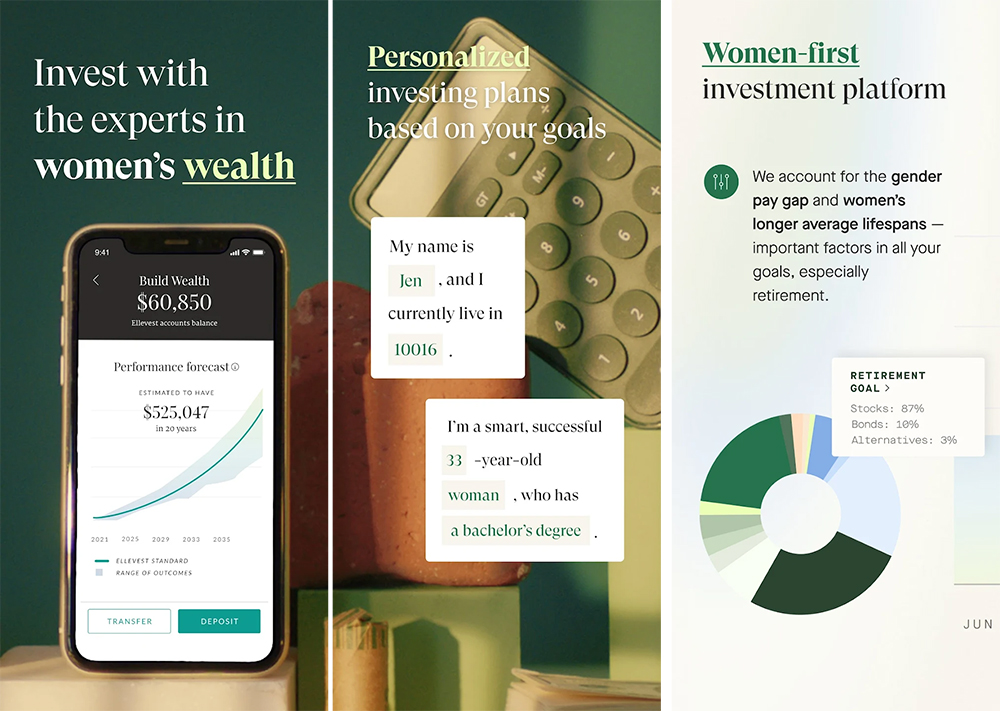

19. Ellevest

Ellevest is an investment management app specifically designed for women, helping them achieve financial independence and manage finances effectively. Using algorithms tailored to factors like age, salary, and spending, Ellevest creates efficient investment strategies that optimize returns and minimize risk.

Key Features:

- Personalized investment advice based on women’s financial goals.

- Savings and investment planning for the future.

- Retirement savings accounts and professional consulting.

- Support for long-term goals like home-buying or retirement.

Available for:

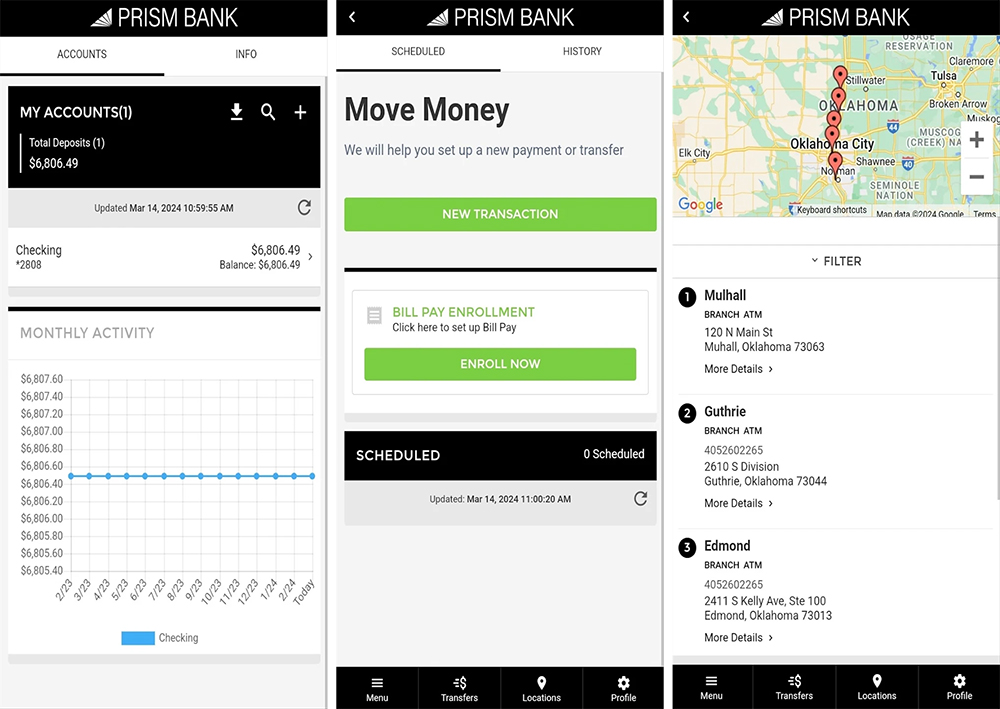

20. Prism

Prism is a useful bill management and payment app that helps users track and pay bills on time automatically. Prism syncs bills from bank accounts, credit cards, and service providers into one interface. It sends reminders for upcoming due dates to prevent missed payments.

Key Features:

- Track all monthly bills in one place.

- Automatic bill payments through the app.

- Alerts for due dates to avoid late fees.

- Easy-to-use interface with payment reminders.

Available for:

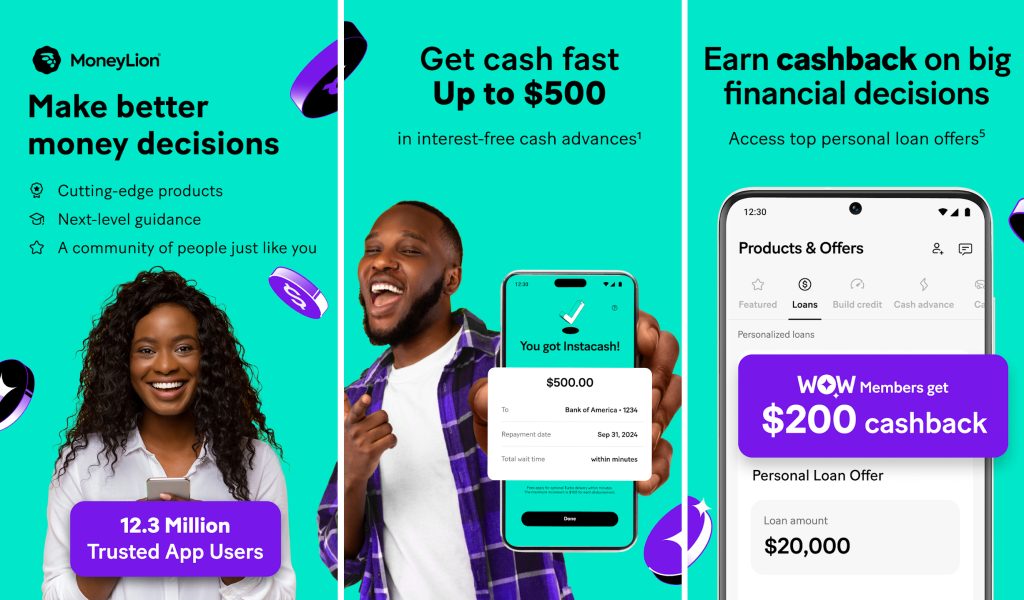

21. MoneyLion

MoneyLion is a financial management app combining digital banking with personal finance services. It provides tools for tracking spending, investing, saving, and loans. MoneyLion offers a no-fee bank account with cashback on purchases, helping users save and grow assets over time.

Key Features:

- No-fee bank account.

- Expense tracking and budgeting tools.

- Loan services directly within the app.

- Rewards program based on financial activity.

Available for:

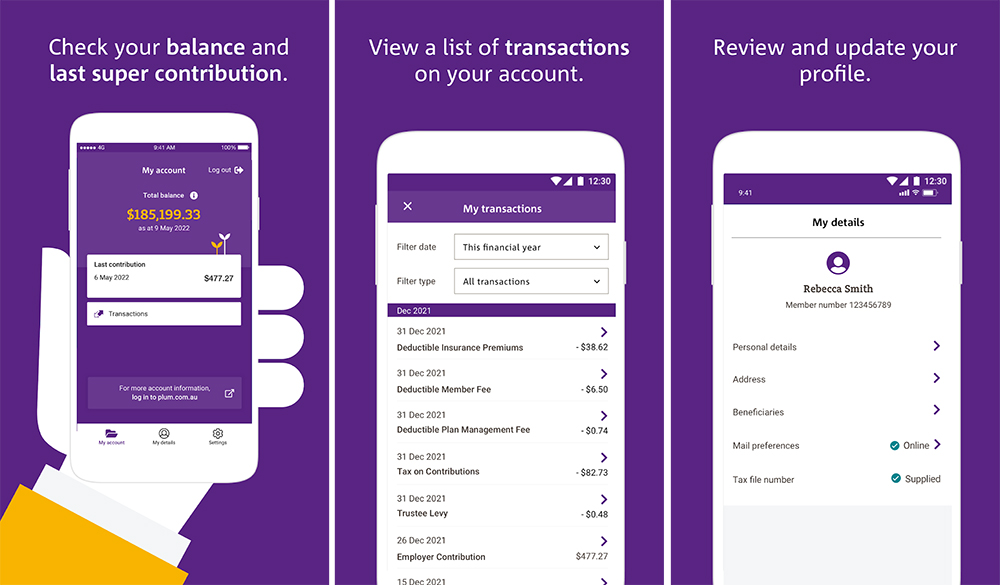

22. Plum

Plum is an automated personal finance app that helps users save and invest through AI. Plum analyzes spending habits and automatically transfers small amounts into a savings account, making it easy to accumulate money effectively.

Key Features:

- Automated savings based on spending behavior.

- Automatic investment in portfolios aligned with financial goals.

- Saving for specific goals like travel or home purchase.

- User-friendly interface.

Available for:

>> Related: Best Free Game Apps for Kids Offline

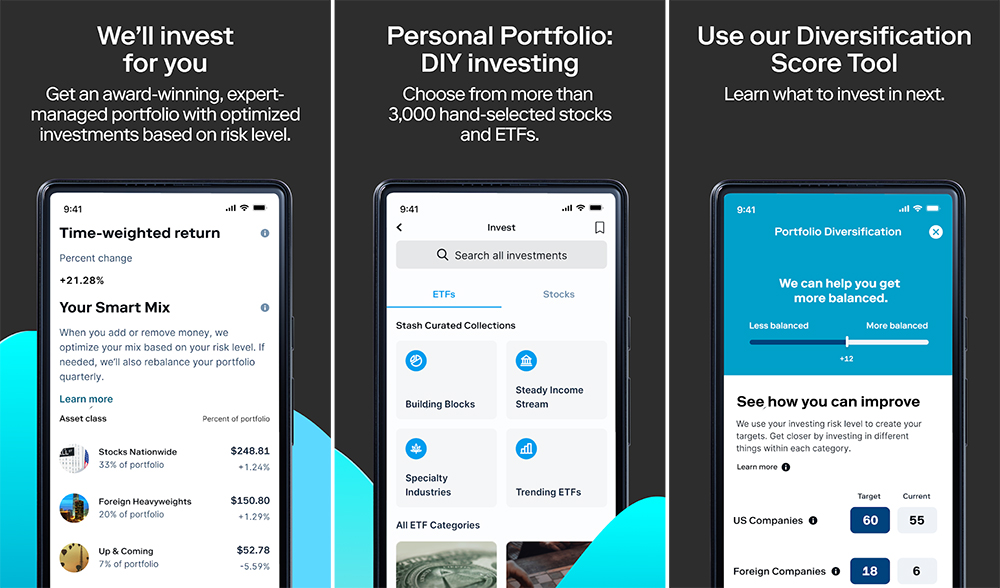

23. Stash

Stash is a personal finance and investment app that allows users to track spending and learn how to invest with small amounts. Users can buy stocks, helping them build assets over time without needing a large initial capital. Stash offers expert-managed portfolios and personalized recommendations, along with educational resources on financial investing.

Key Features:

- Personal finance management and investment in stocks and ETFs.

- Start investing with small amounts.

- Automatic transfers for investing and saving.

- Personalized portfolio recommendations based on user goals.

Available for:

24. Buxfer

Buxfer is a flexible personal finance app that helps users track income, expenses, and savings. Buxfer enables users to record spending, set budget limits, and monitor if spending aligns with their plans. It also has group expense-sharing features, making it ideal for couples, friends, or families managing finances together.

Key Features:

- Connect with multiple bank accounts and credit cards.

- Expense tracking, budgeting, and debt management.

- Easy group expense sharing and tracking.

- Detailed financial reports and trend analysis.

Available for:

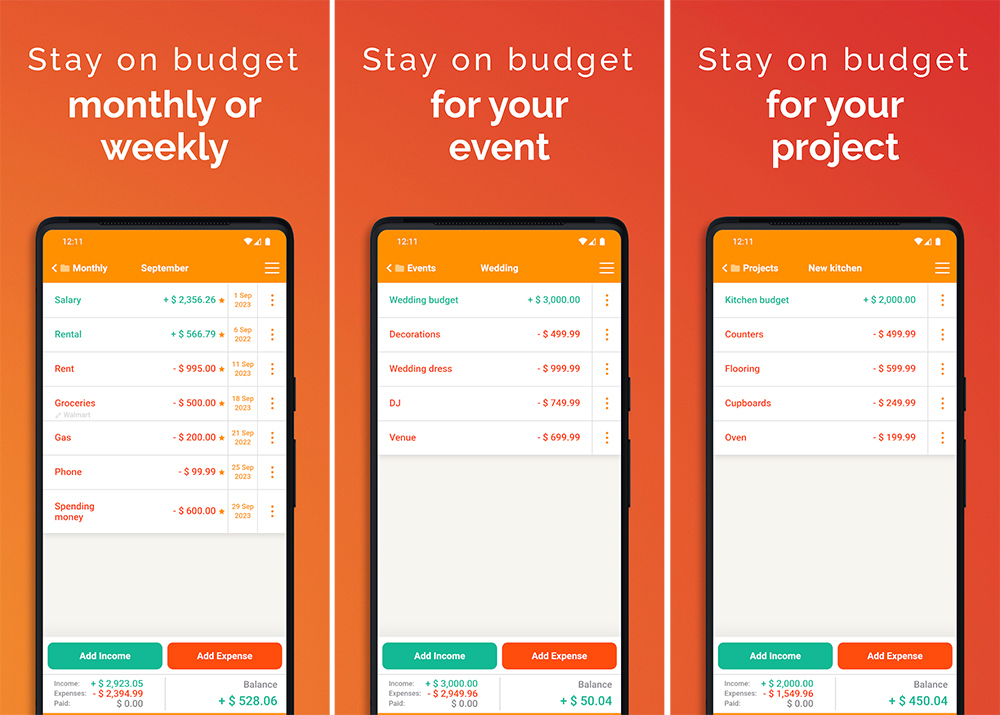

25. Fudget

Fudget is a simple and user-friendly personal finance management app, ideal for those looking for a straightforward budgeting tool without complex features. Fudget allows users to create easy-to-manage lists of income and expenses to keep track of their finances. The app forgoes charts and complex categorization, focusing solely on essential functions, making it simple to track and log expenses.

Key Features:

- No bank account connection required; manual data entry.

- Straightforward budgeting and expense tracking without extra complexity.

- Ad-free, focusing solely on user experience.

- Financial forecasting for upcoming months.

Available for:

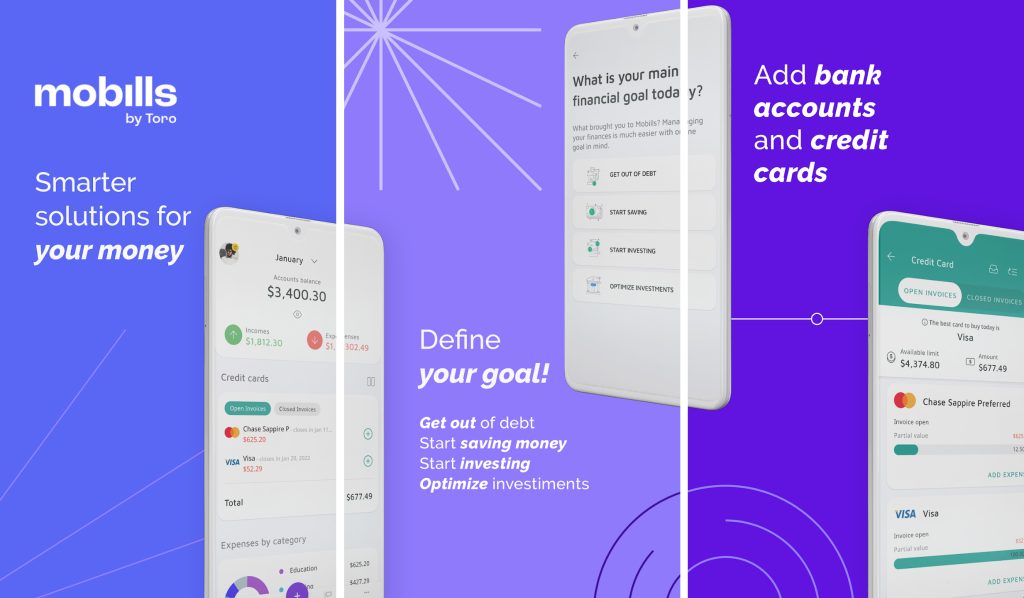

26. Mobills

Mobills is a versatile personal finance management app with an intuitive and user-friendly interface. It allows users to track income, set budgets, and view detailed expense charts, giving them a clear overview of their cash flow and enabling effective financial optimization.

Key Features:

- Track income, expenses, and personal budgets.

- User-friendly interface with detailed financial charts.

- Financial planning with specific financial goals.

- Cloud synchronization, allowing access across multiple devices.

Available for:

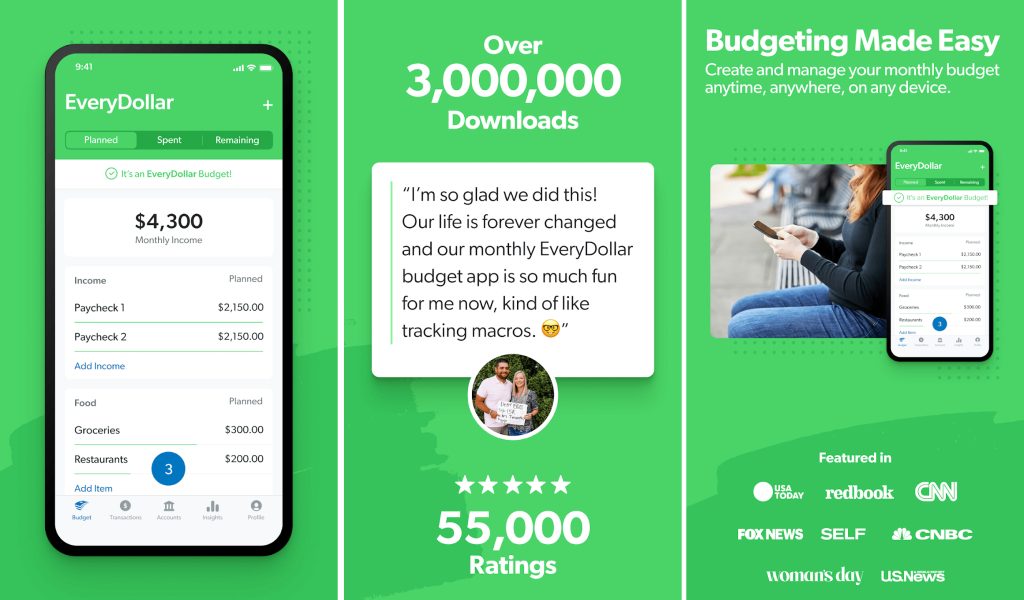

27. EveryDollar

EveryDollar is a personal finance management app developed by Dave Ramsey, a renowned personal finance expert in the United States. This app helps users track and plan their monthly budget in detail, providing an overall view of their finances and helping achieve long-term savings goals.

Key Features:

- Category-based budgeting, easily adjustable and trackable.

- Automatic bank account synchronization.

- Integration of Dave Ramsey’s financial management approach.

- Reporting tools to monitor progress in spending and saving.

Available for:

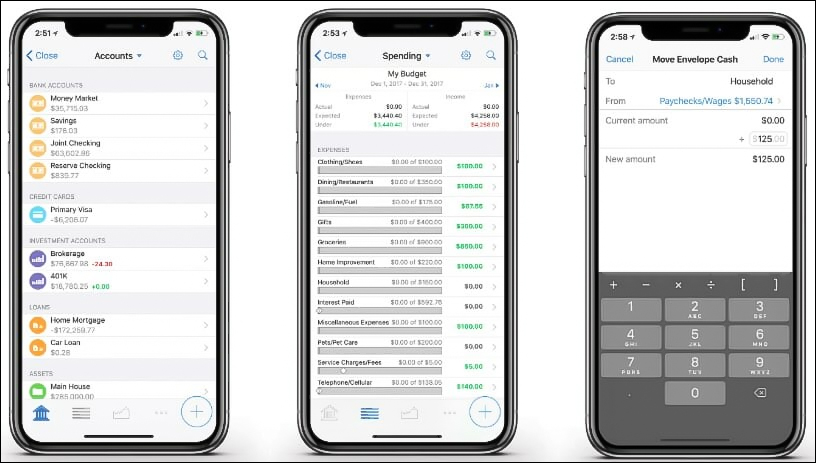

28. Banktivity

Banktivity is a personal finance app designed exclusively for Apple users, including Mac and iOS devices. It enables users to create custom budgets, track spending, and compare it against their set budget, helping them monitor and control their finances effectively.

Key Features:

- Expense tracking, budgeting, and investment management.

- Multi-currency support and international financial analysis.

- Detailed financial reports and expense analysis tools.

- Data synchronization across Apple devices.

Available for:

The bottom line

Personal finance management apps have become increasingly essential for many, and the “Personal Financial Management Applications” listed above can help you effectively manage income, expenses, and investments. Download one to build good financial habits and invest wisely!